But the outrage over the AIG bonuses is a sideshow. The larger problem, both financially and politically, is the entire strategy for rescuing the banks.

It would be hard to imagine two administrations seemingly more opposite than the Bush and the Obama presidencies. Yet Geithner's approach is essentially a continuation of the failed strategy of Bush Treasury Secretary Henry Paulson, Geithner's former close colleague in Geithner's prior role as president of the New York Fed.

In defending the AIG bonuses, CEO Edward Liddy actually said that you had to pay bonuses to attract and keep "the best and brightest talent," in this case the very people who are costing America's taxpayers $175 billion and counting. Far from receiving bonuses, these people deserve to share a cell with Bernie Madoff.

By the same token, Larry Summers and Tim Geithner are not the only smart people about finance. If President Obama wants a second opinion, he could begin with Paul Volcker, nominally chairman of Obama's own "Economic Recovery Advisory Board," which so far is mainly window-dressing. According to my sources, Summers and Geithner seldom talk to Volcker because they don't like Volcker's criticisms of their plan.

The president could also consult with several people in the Federal Reserve System who have a different view, and also the FDIC leadership, and the Congressional Oversight Panel that was created by Congress as the precondition for appropriating the TARP money. The panel has the statutory right to get documents from the Treasury. But under Geithner as under Paulson before him, Treasury has been stonewalling. Legislators of both parties are increasingly viewing Geithner as part of the problem.

As the administration continues its coziness with Wall Street and the approach fails to bring zombie banks back to life, populist anger passes to both the Republicans and to media tribunes such as Lou Dobbs. This brand of populism is one part anti-Wall Street, but two parts anti-government and anti-immigrant. It has no strategic coherence as a recovery plan.

The alternative to Lou Dobbs' brand of populism is of course Franklin Roosevelt's. But something is really off when Sen. Sam Brownback, the AEI, and the Kansas City Federal Reserve Bank start sounding more like Roosevelt than Barack Obama's treasury secretary does.

Obama needs to get a second opinion, firsthand.

“This is slavery, not to speak one's thought.” ― Euripides, The Phoenician Women

Monday, March 16, 2009

Robert Kuttner on the AIG Scandal

From the Huffington Post:

Sunday, March 15, 2009

To End Financial Crisis, Cancel All Credit Default Swaps

(ht Daily Kos) The so-called credit default swaps were fraudulent wagers that should be declared null and void as gambling debts, and therefore unenforcable. In fact, Congress acted in 2000--during the Clinton administration, thanks to help from the likes of Senate Finance Committee Chairman Chris Dodd--to exempt such wagers from existing state gambling law. The obvious solution is to rescind that 2000 legislation and treat credit default swap debt as illegal gambling (which it clearly was, given the results). As explained by Moon of Alabama, Sept. 21, 2008, there is a precedent from the Great Depression era:

At the bottom of the inverted financial pyramid are overvalued land, wood structures, dry walls and granite countertops - i.e. cheaply over-build houses.

These were sold to people who could only afford them with mortgages that had unrealistic starting conditions and on the premise that housing prices would continue to rise forever.

These mortgages were bundled, sliced and diced into Mortgage Backed Securities and sold to investors. Home equity loans, car-loans and credit card debt were converted to Asset Backed Securities and sold off.

On top of these MBS/ABS papers some geniuses constructed an additional financial layer.

These were insurance contracts that covered against the default of ABS, MBS and various types of bonds. These insurance contracts, Credit Default Swaps, are totally unregulated private agreements. They were widely created and dealt with when the risk of default of the underlying papers was assumed to be low.

Some of the insurers who issued these CDS never had the capital to back all the policies they wrote. In a competitive environment they offered too low premiums to insure against default risks.

Some insurers partly insured themselves via reinsurance. When they sold a CDS on a bond issue of some $10 million they went to other insurers and bought themselves CDS, let's say $5 million or perhaps even for $20 million. The re-insurers partly re-insured themselves again by buying CDS elsewhere.

Some people simply betted on a change in the default risk of some bonds. They did not even own the MBS or bond in question, but bought or sold insurance against the default of a specific MBS or bond anyway. Some may have bought total insurance from different insurers in a way that a default of the MBS would pay them ten times the nominal value of said MBS.

Imagine you could have ten fire insurances on your home that would each pay out the full value of your house if it burns down. That would probably give you some very hot ideas.

That is exactly the reason why fire insurance regulation prevents such a case. But CDS are unregulated, their originators are unregulated and there is no settlement mechanism for them other than the private contracts between the parties.

The original size of the mortgages going into default are probably $300-500 billion. The total mortgage origination in the last years were a few trillion dollars. These and additionally credit card loans and auto loans that were converted to Asset Backed Securities in a volume of about $6 trillion.

But on top of these $6 trillion of MBS/ABS and bonds insurances, re-insurances and re-re-insurances were written with an estimated total nominal value of some $65+ trillion. The real number is unknown, but it is bigger than the whole worlds yearly GDP.

Now the housing bubble busted. There was simply too much supply created to sustain ever rising prices. Without rising house prices a lot of homeowners had to default on their mortgages.

With the mortgages going into foreclosure, the MBS and other asset backed papers where suddenly less worth than expected. This triggered credit insurance events. People who had bought the Credit Default Swaps suddenly demanded money from their insurers.

It turns out that these insurers, or their re-insurers, or whoever meanwhile carries the now negative side of the CDS in question are out of money and the insurance agreements are worthless. The worlds biggest insurer, AIG, was nationalized because it had written too much credit insurance for too low prices.

The big danger now are not defaulting homeowners. The big danger are not Asset Backed Securities that might lose some value.

The big danger is the pyramid of credit insurances that is certain to come down and that will take with it at least half of the existing finance infrastructure.

Banks, hedge funds, pension funds, municipals and others who bought insurance will find that it is worthless. Banks, hedge funds an others who sold insurances will find that they will have to pay out more than their total capital.

We currently see a credit-freeze because nobody wants to lend to anybody as it is impossible to know how much credit insurance the other party has written or how much it depends on their validity. You do not lend to anyone who might already be bust.

That is the situation we are in and it shows why the Paulson plan is utter crap and nothing but a huge robbery.

The Paulson plan would not help at the bottom of the inverted pyramid, the housing market, and not at the top, in the CDS market.

Paulson knows that the crash of the CDS market is inevitable. His plan is an attempt to let the taxpayer pay for the stabilization of the middle of the pyramid in the hope that the big crash will come only after the election (and in the hope that the loot might help Paulson's beloved Goldman Sachs to survive.)

There is only way to avert the crash.

Declare all CDS contracts, worldwide, as null and void. There is precedence for this:

During the Great Depression, many debt contracts were indexed to gold. So when the dollar convertibility into gold was suspended, the value of that debt soared, threatening the survival of many institutions. The Roosevelt Administration declared the clause invalid, de facto forcing debt forgiveness. Furthermore, the Supreme Court maintained this decision.

The maze of the value and ownership of $65+ trillion of financial credit insurance contracts has frozen the credit markets. Nobody is lending to anybody else because the value of the counterparty is in doubt.

Those $65 trillion reasons for the credit market freeze will never go away without a huge crash that then will have worth consequences than the 1929 stock market crash. The only way to eliminate these reasons is internationally concerted action to declare the legal obligations of all CDS' null and void.

At the same time:

Friday, March 13, 2009

Jon Stewart v Jim Cramer

(ht drudge/breitbart)

For more, see What We Should Learn From Jim Cramer vs The Daily Show's Jon Stewart by Patrick Byrne on DeepCapture Blog

Time to re-open the SEC investigation into allegations that Cramer engaged in stock manipulation quashed by former SEC chairman Chris Cox?

For more, see What We Should Learn From Jim Cramer vs The Daily Show's Jon Stewart by Patrick Byrne on DeepCapture Blog

Time to re-open the SEC investigation into allegations that Cramer engaged in stock manipulation quashed by former SEC chairman Chris Cox?

Thursday, March 12, 2009

The Washington Post on Chas Freeman's Withdrawal

From today's Washington Post:

BTW, I hope someone is looking into a replacement for Director of National Intelligence Dennis Blair. His handling of this nomination was unbelievably stupid. I don't care if he did go to Oxford as a Rhodes Scholar and is a classmate of Bill Clinton. Political analysis is one of the jobs of an intelligence analyst--and he failed his first important test. The nation can't afford to have someone politically dumb as Blair, as DNI.

Blame the 'Lobby'IMHO, Freeman's self-serving and misleading statement is evidence enough that he was the wrong pick for head of the National Intelligence Council...let alone obvious questions of possible personal financial obligation to Saudi Arabia and/or China, among others, through NGOs and businesses dependent on government favors. Even if he were a "double agent," how could Americans ever be sure who's side he really was on? Patriotism is the last refuge of a scoundrel...the next-to-last: Blaming the Jews.

The Obama administration's latest failed nominee peddles a conspiracy theory.

FORMER ambassador Charles W. Freeman Jr. looked like a poor choice to chair the Obama administration's National Intelligence Council. A former envoy to Saudi Arabia and China, he suffered from an extreme case of clientitis on both accounts. In addition to chiding Beijing for not crushing the Tiananmen Square democracy protests sooner and offering sycophantic paeans to Saudi King "Abdullah the Great," Mr. Freeman headed a Saudi-funded Middle East advocacy group in Washington and served on the advisory board of a state-owned Chinese oil company. It was only reasonable to ask -- as numerous members of Congress had begun to do -- whether such an actor was the right person to oversee the preparation of National Intelligence Estimates.

It wasn't until Mr. Freeman withdrew from consideration for the job, however, that it became clear just how bad a selection Director of National Intelligence Dennis C. Blair had made. Mr. Freeman issued a two-page screed on Tuesday in which he described himself as the victim of a shadowy and sinister "Lobby" whose "tactics plumb the depths of dishonor and indecency" and which is "intent on enforcing adherence to the policies of a foreign government." Yes, Mr. Freeman was referring to Americans who support Israel -- and his statement was a grotesque libel.

For the record, the American Israel Public Affairs Committee says that it took no formal position on Mr. Freeman's appointment and undertook no lobbying against him. If there was a campaign, its leaders didn't bother to contact the Post editorial board. According to a report by Newsweek, Mr. Freeman's most formidable critic -- House Speaker Nancy Pelosi -- was incensed by his position on dissent in China.

But let's consider the ambassador's broader charge: He describes "an inability of the American public to discuss, or the government to consider, any option for U.S. policies in the Middle East opposed by the ruling faction in Israeli politics." That will certainly be news to Israel's "ruling faction," which in the past few years alone has seen the U.S. government promote a Palestinian election that it opposed; refuse it weapons it might have used for an attack on Iran's nuclear facilities; and adopt a policy of direct negotiations with a regime that denies the Holocaust and that promises to wipe Israel off the map. Two Israeli governments have been forced from office since the early 1990s after open clashes with Washington over matters such as settlement construction in the occupied territories.

What's striking about the charges by Mr. Freeman and like-minded conspiracy theorists is their blatant disregard for such established facts. Mr. Freeman darkly claims that "it is not permitted for anyone in the United States" to describe Israel's nefarious influence. But several of his allies have made themselves famous (and advanced their careers) by making such charges -- and no doubt Mr. Freeman himself will now win plenty of admiring attention. Crackpot tirades such as his have always had an eager audience here and around the world. The real question is why an administration that says it aims to depoliticize U.S. intelligence estimates would have chosen such a man to oversee them.

BTW, I hope someone is looking into a replacement for Director of National Intelligence Dennis Blair. His handling of this nomination was unbelievably stupid. I don't care if he did go to Oxford as a Rhodes Scholar and is a classmate of Bill Clinton. Political analysis is one of the jobs of an intelligence analyst--and he failed his first important test. The nation can't afford to have someone politically dumb as Blair, as DNI.

Tuesday, March 10, 2009

You Can Believe This Article In Today's Salt Lake Tribune:

Headline: Jews celebrate Purim with hamantaschen:

The Jewish holiday of Purim is not as well-known as Hanukah or Passover, but the late-winter celebration is just as much fun. This year it falls on March 10.Hag Sameach!

Children wear costumes and listen to stories. Adults sip wine and everyone eats hamantaschen, buttery shortbread cookies usually filled with fruit preserves, nuts and spices or poppy seeds

Haman's pockets, as they are sometimes called, were brought to America by Jews from the eastern part of Germany and Eastern Europe, cookbook author Joan Nathan notes in Jewish Cooking in America .

"Hamantaschen are so popular that many academic institutions hold an annual hamantaschen vs. latke debate," she notes.

Monday, March 09, 2009

Daily Telegraph (UK): USAID Killed Zimbabwe Opposition Leader's Wife

In the US, if this Telegraph story is true, and the US Agency for International Development paid for the truck that killed Mrs. Tsvanirai, Morgan Tsvangirai's attorneys might be able to sue the US government for negligent homicide in an American court. In any case, I hope the US Congress and Obama administration look into the question of USAID's responsibility (as well as the British development agency mentioned) for this tragedy:

Mrs Tsvangirai, 50, died at the scene of the accident, on the main road leading south from the capital. Her husband is said to be "very devastated" by her death.

MDC party officials have called for an investigation into the circumstances of the crash, at 4pm on Friday. The couple's Toyota Landcruiser rolled three times after it was hit by a lorry which is understood to have swerved into their path to avoid a pothole.

ABC News in the United States cited unnamed US officials as saying the truck belonged to a contractor working for the US and British governments.

The truck, which had a USAID insignia on it, was purchased by US government funds and its driver was hired by a British development agency, the report said. USAID stands for the US Agency for International Development.

State media in Zimbabwe had earlier reported that the lorry involved in the incident belonged to the US government aid organisation, USAID, and was carrying Aids medicines to Harare. A US Embassy official in the capital confirmed that the vehicle had been contracted to USAID.

Piccolo Art

At the DC Spring Antiques Show yesterday, someone I know happened on a 19th century watercolor at a stand called Piccoloart. When our small group of visitors descended, proprietor Nancy Christman Reilly was so charming--even reciting a stanza from Robert Burns's Address To A Haggis in front of portraits featuring two tartan-clad worthies--that we bought three smaller 19th century pictures right off the wall. The mom-and-pop Reillys hail from Ohio, spent years in England, Nancy trained at Sotheby's, and they now live and work in Edenton, North Carolina, of all places...If you are interested in British portraits and miniatures--or the poetry of Robert Burns--the DC Spring Antiques Show is open today until 6 pm at the Washington Convention Center.

Saturday, March 07, 2009

Happy International Women's Day!

Here's a link to the official webpage for March 8th, my favorite holiday in the former USSR. BTW, they seem to have some corporate sponsors nowadays--including HSBC, Skype, and Cisco Systems.

IMHO, Maybe President Obama could add the US to the list of nation's that celebrate women? We need all the holidays we can get, in these troubled economic times...

IMHO, Maybe President Obama could add the US to the list of nation's that celebrate women? We need all the holidays we can get, in these troubled economic times...

Monday, March 02, 2009

Peter Schiff on the Perils of Obama's Economic Strategy

From the website of an economic forecaster who predicted Wall Street's meltdown:

The existence of credit in no way increases aggregate consumption within this community, it merely temporarily alters the way consumption is distributed. The only way for aggregate consumption to increase is for the production of candlesticks, steak, and bread to increase.

One way credit could be used to grow this economy would be for the candlestick maker to borrow bread and steak for sustenance while he improves the productive capacity of his candlestick-making equipment. If successful, he could repay his loans with interest out of his increased production, and all would benefit from greater productivity. In this case the under-consumption of the butcher and baker led to the accumulation of savings, which were then loaned to the candlestick maker to finance capital investments. Had the butcher and baker consumed all their production, no savings would have been accumulated, and no credit would have been available to the candlestick maker, depriving society of the increased productivity that would have followed.

On the other hand, had the candlestick maker merely borrowed bread and steak to sustain himself while taking a vacation from candlestick making, society would gain nothing, and there would be a good chance the candlestick maker would default on the loan. In this case, the extension of consumer credit squanders savings which are now no longer available to finance other capital investments.

What would happen if a natural disaster destroyed all the equipment used to make candlesticks, bread and steak? Confronted with dangerous shortages of food and lighting, Barack Obama would offer to stimulate the economy by handing out pieces of paper called money and guaranteeing loans to whomever wants to consume. What good would the money do? Would these pieces of paper or loans make goods magically appear?

The mere introduction of paper money into this economy only increases the ability of the butcher, baker, and candlestick maker to bid up prices (measured in money, not trade goods) once goods are actually produced again. The only way to restore actual prosperity is to repair the destroyed equipment and start producing again.

The sad truth is that the productive capacity of the American economy is now largely in tatters. Our industrial economy has been replaced by a reliance on health care, financial services and government spending. Introducing freer flowing credit and more printed money into such a system will do nothing except spark inflation. We need to get back to the basics of production. It won’t be easy, but it will work.

President Obama would have us believe that we can all spend the day relaxing in a tub while his printing press does all the work for us. The problem comes when you get out of the tub to go to dinner and the only thing on your plate is an IOU for steak.

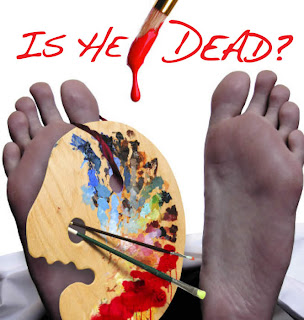

Mark Twain's Is He Dead? at the Olney Theatre

Olney Theatre's Saturday matinee production of Mark Twain's Is He Dead? (through March 8th) was a delight. Mark Twain's view of the European art world, written when he lived in Vienna! What could be better than that? Not cornpone, but cosmopolitan, Mark Twain...in a production of a charming, laugh-out-loud farce. And one of the the first jokes was about a bank collapse.

A brief internet search revealed the show played on Broadway in 2008, directed by Michael Blakemore. The manuscript, discovered by Shelly Fisher Fishkin, has been published as by the University of California Press. And a review by Mark Dawidziak, on Twainweb.net, explains why it is so worthwhile:

First and foremost, Is He Dead? must be considered an important contribution to literary scholarship in general and Twain studies in particular. This is decidedly third-rate Twain, but what of it? No work by Mark Twain is uninteresting or unimportant, after all, so anything he wrote should prove fascinating reading from a purely literary standpoint.

If we recovered a largely unknown and inferior play by Tennessee Williams, would it be of interest? Would its publication be almost a sacred duty? You bet your jumping frog it would. Even the failures of a genius command our attention.

Working with a text established by the incomparable Mark Twain Project team in Berkeley, Fishkin has gone beyond the previous researchers who gave slight notice to the play and has endeavored to bring it to public attention. And as the line goes from Arthur Miller's Death of a Salesman, "attention must be paid." So the student of literature, as well as theater, has much to mull over here. For better or worse, this is a complete work by Mark Twain, folks, and those don't pull into town on the noon stage every day.

From the purely Twainian standpoint, Is He Dead? is still more fascinating. The Twain buff can and should have a jolly time reading the play, noticing along the way how many distinct echoes there are of previous works. Liberally "borrowing" from himself, Twain pulls out the humorous description of the "long, low dog" (the dachshund) from Following the Equator. He appropriates the pungent idea of limburger cheese being mistaken for a rotting corpse from "The Invalid's Story." He repeats the routine of vague and perplexing answers from "An Encounter with an Interviewer." He resurrects jokes from "His Grandfather's Old Ram" in Roughing It. He lifts the device of the story's hero watching his own funeral from Tom Sawyer. And on and on goes the game of "spot the influences." In fact, the entire play is based on his 1893 short story, "Is He Living or Is He Dead?" In this tale, we are told how French artist Jean-Francois Millet faked his own death, knowing that unknown painters often become hot items after they are dead. Sure enough, the lionized Millet becomes "posthumously" rich and famous.

All of these associations are wonderfully detailed in Fishkin's insightful foreword and afterword material, which provide splendid background on "Mark Twain and the Theatre," "Mark Twain and Art," the real Millet's life and career, the play's many associations to other Twain works, the theater of Twain's day, and Twain's attempts to get Is He Dead? produced.

The Twainiac will find Fishkin's illuminating essays as valuable as the play itself. They provide all the necessary context for approaching and appreciating the comedy about Millet and his artist friends. You may not agree with Fishkin on the quality of the play, but you can't help being impressed by the thoroughness of her research and the vitality of her writing. As elegant as Fishkin's prose are the original illustrations by woodcut engraver Barry Moser, the Pennyroyal Press proprietor whose work graced the 100th anniversary edition of Huckleberry Finn published by the University of California Press in 1985.

Twain said he wrote the play for fun, and that's precisely how a Twain aficionado should read it. Some of the lines are vintage Twain. There are several nifty phrasings ("O, shucks! you don't know as much as an art-critic," one of the starving artists says to another). And the writer manages to sneak in a few withering satirical blasts at the art world, society and, of course, the French. In many ways, Is He Dead? is a better play than, say, Twain's miserable attempt to adapt Tom Sawyer. There's no whitewashing the ineptitude of that terribly off-key effort, which, despite being based on a book the author called "simply a hymn," also demonstrates Twain's tin ear as a playwright.

Salman Rushdie v Slumdog Millionaire

The author of The Satanic Verses doesn't seem to like the film any more than I do. From The Guardian:

What can one say about Slumdog Millionaire, adapted from the novel Q&A by the Indian diplomat Vikas Swarup and directed by Danny Boyle and Loveleen Tandan, which won eight Oscars, including best picture? A feelgood movie about the dreadful Bombay slums, an opulently photographed movie about extreme poverty, a romantic, Bollywoodised look at the harsh, unromantic underbelly of India - well - it feels good, right? And, just to clinch it, there's a nifty Bollywood dance sequence at the end. (Actually, it's an amazingly second-rate dance sequence even by Bollywood's standards, but never mind.) It's probably pointless to go up against such a popular film, but let me try.

The problems begin with the work being adapted. Swarup's novel is a corny potboiler, with a plot that defies belief: a boy from the slums somehow manages to get on to the hit Indian version of Who Wants to Be a Millionaire and answers all his questions correctly because the random accidents of his life have, in a series of outrageous coincidences, given him the information he needs, and are conveniently asked in the order that allows his flashbacks to occur in chronological sequence. This is a patently ridiculous conceit, the kind of fantasy writing that gives fantasy writing a bad name. It is a plot device faithfully preserved by the film-makers, and lies at the heart of the weirdly renamed Slumdog Millionaire. As a result the film, too, beggars belief.

It used to be the case that western movies about India were about blonde women arriving there to find, almost at once, a maharajah to fall in love with, the supply of such maharajahs being apparently endless and specially provided for English or American blondes; or they were about European women accusing non-maharajah Indians of rape, perhaps because they were so indignant at having being approached by a non-maharajah; or they were about dashing white men galloping about the colonies firing pistols and unsheathing sabres, to varying effect. Now that sort of exoticism has lost its appeal; people want, instead, enough grit and violence to convince themselves that what they are seeing is authentic; but it's still tourism. If the earlier films were raj tourism, maharajah-tourism, then we, today, have slum tourism instead. In an interview conducted at the Telluride film festival last autumn, Boyle, when asked why he had chosen a project so different from his usual material, answered that he had never been to India and knew nothing about it, so he thought this project was a great opportunity. Listening to him, I imagined an Indian film director making a movie about New York low-life and saying that he had done so because he knew nothing about New York and had indeed never been there. He would have been torn limb from limb by critical opinion. But for a first world director to say that about the third world is considered praiseworthy, an indication of his artistic daring. The double standards of post-colonial attitudes have not yet wholly faded away.

Kuttner v Geithner: Are Geithner's Days Numbered?

Liberals seem to be turning against Geithner...at least Robert Kuttner is.From the Huffington Post:

The government can either act quickly, the way the Swedes did when they faced a similar financial collapse; or the government can belatedly take banks over after delaying and trying half-measures, the way the Japanese did it. The Swedish economy got back on track and the banking system was returned to private ownership in fairly short order. The Japanese economy bled for a decade.

Why is Geithner dithering? Because he is asking the wrong question. The question he is posing is: how can the government save Citigroup? The right question is: how can the government rebuild the banking system?

Some in the administration may be wishing that they hadn't called in so many chits with senators to save Geithner from the consequences of his failure to comply with the tax laws. On the ability of Geithner (or his successor) to get this job done properly hangs the fate of the banking system, the capacity of the economy to avert a depression, and the political fortunes of the Obama administration.

Sunday, March 01, 2009

The Unsolved Mystery of Raoul Wallenberg's Fate

So, it was interesting that Prager's article explains why we still don't know what happened to Wallenberg--Western governments deliberately abandoned Wallenberg because of the Cold War, even Sweden's leaders and members of his own family didn't want to know:

Peter Wallenberg, 82, says his father, Marcus, who co-headed the family bank, had told him that Raoul's mother had asked the Wallenbergs not to interfere. "You didn't do things without total government consent," he added. "And there was not total government consent in regards to Raoul."Let me add my voice to the chorus: "Mr. Putin, Release Raoul Wallenberg's file!"

'Slippery as an Eel'

Mr. von Dardel increasingly scorned that government. He wrote that ambassador Rolf Sohlman was an "ineffective bastard," prime minister Erlander "slippery as an eel," foreign minister Undén "horrible."

***

The year was 2000. The siblings were to assume their brother dead. But Ms. Lagergren couldn't bring herself to do so. The time, she says, "was not ripe yet."

In January 2001, the Swedish-Russian group that included Mr. von Dardel published its final report on Mr. Wallenberg. It was inconclusive.

Days later, Swedish Prime Minister Göran Persson phoned the siblings. Recalls Mr. Persson: "It was an expression of apology from the kingdom of Sweden."

The prime minister failed to comfort. "How can one call after so many years?" asks Ms. Lagergren. "Just call?"

In short order, Mr. von Dardel broke his hip, got a pacemaker, caught pneumonia and, says his family, spoke less and less. He stopped speaking of his brother.

His doctors were unsure why. His family wasn't. "You understand now," says his daughter, Louise, "that the illness is Raoul Wallenberg illness."

In 2003, a commission appointed by the Swedish prime minister published "A Diplomatic Failure," an open critique of Sweden's policy toward its missing diplomat. "Diplomatic opportunities that might have helped Wallenberg were missed," says Sweden's current deputy foreign minister, Frank Belfrage.

Mr. Lundvik, the ambassador who long handled the Wallenberg case, is more blunt. "The Swedish government did not want him back," he says.

In 2005, Mr. von Dardel's younger daughter, Marie Dupuy, emptied the contents of her father's living-room closet into her Peugeot and drove it to her home in Versailles, France. She divided some 50,000 pages into 75 bins. One was devoted to her father's career in physics, 74 to his missing half-brother.

***

Eight days later, Mr. von Dardel sat silently in Room 233 of a Geneva hospital. Belted to a recliner chair, his hospital bracelet sliding over his thin right forearm, he listened to this reporter recount his family's search.

"I think it was very unfair," he said in a faint voice, of the brunt of two suicides on his sister. "Nina was in the center position."

Talk turned to the search.

"One should go to the top," he said.

Vladimir Putin?

"Yes."

What would he like to tell the Russian leader?

Days before turning 89, Mr. von Dardel summoned his strength: "If we sit down...try to find out...the real hope would be if new information..."

Did he still think about Raoul?

"Yes, I do," Mr. von Dardel answered in his strongest voice.

Later, he added: "I see him in Russia."

UPDATE: Recently received this email:

Dear Mishpucha,

Hope everyone is well.

Please find enclosed as an attachment a very moving Wall Street Journal newspaper article entitled "The Wallenberg Curse," by Joshua Prager. (You can also find the article at: http://online.wsj.com/article/SB123207264405288683.html)

It is the story of how the Raoul Wallenberg family tried to obtain justice for diplomat rescuer Raoul Wallenberg. As many of you know, Raoul Wallenberg volunteered to rescue Jews in Budapest from July 1944 through January 1945. He is credited with saving the lives of 20,000 Hungarian Jews.

On January 17, 1945, Raoul Wallenberg was arrested by the Soviet Army in Budapest.

It has been 64 years since Raoul Wallenberg was arrested by the Soviet occupying forces of Budapest. Still, there is no conclusive evidence as to what happened to him. Still his family grieves.

Raoul's brother, Guy von Dardel, and his sister, Nina Lagergren, have been seeking to determine the fate of their brother for decades. This has been an enormous emotional and financial burden for the family.

As you will see in the article, Raoul's mother and stepfather committed suicide in 1979 related to the emotional strain.

The family feels that the world has lost interest in finding justice for Raoul Wallenberg.

The Visas for Life: The Righteous and Honorable Diplomats Project supports the Wallenberg and von Dardel and Lagergren family in their quest for justice.

Our Project has included Raoul Wallenberg in all of our exhibition venues. We have sponsored Louise von Dardel, daughter of Guy von Dardel, to attend many of the Visas for Life exhibit venues. This included meetings with Secretary of State Colin Powell and Senators Feinstein and Boxer. We are presently developing a program to honor Raoul Wallenberg as part of a program to commemorate the activities of the US War Refugee Board, of which Raoul Wallenberg was an integral part.

The Visas for Life: The Righteous and Honorable Diplomats Project encourages the United States, Russia, Sweden, and Israel to continue the seek justice for Raoul Wallenberg and his family. We will continue to support the family in any way they feel appropriate. We hope you will join in that support.

If you wish to support the Wallenberg family or relay letters of support, please contact me at VisasForLife@cs.com.

Best regards,

Shalom,

Eric

Eric Saul

Executive Director

Visas for Life: The Righteous and Honorable Diplomats Project

Institute for the Study of Rescue and Altruism in the Holocaust, a nonprofit corporation

810 Windwood Place

Morgantown, WV 26505

(304) 599-0614

VisasForLife@cs.com

Friday, February 27, 2009

Bill Moyers Confesses He Asked FBI To Spy

In Slate, in response to Jack Shafer's articles about FBI investigations of Jack Valenti's sexuality (ht Edge):

More "tips" from the FBI followed. We in the White House were walking a very delicate line. Here was the director of the FBI, who at the time was lionized by the public, the press, and both political parties, informing the president of potentially explosive allegations from "anonymous informants" concerning members of his staff and administration. If we ignored them, we were leaving ourselves open to blackmail or possibly reprisals from Hoover himself, or both. We certainly could not afford another incident like the one with Walter. And so, yes, we did ask the FBI to follow up on a handful of these reports.

Bomb Damages Caracas Synagogue

The Jewish Telegraphic Agency reports:

(JTA) -- A Caracas synagogue was damaged by a bomb.

The homemade grenade, tossed late Thursday night into the Orthodox Beit Shmuel synagogue, damaged windows and a car; no injuries were reported.

It was the second such attack this year on a Jewish site in Caracas. Eleven people, including eight policemen, are under arrest for vandalizing a Caracas synagogue last month. In that attack, the walls were painted with anti-Semitic slogans, religious objects were damaged and thieves stole a database listing Venezuela's Jews.

Jewish leaders in Venezuela and overseas accused President Hugo Chavez of stoking tensions with rhetoric comparing Israel's actions in the Gaza Strip to Nazi oppression.

The Chess Players (1977)

The Oscar success of Slumdog Millionaire--IMHO, a manipulative phony British exploitation film about boarding school sadism pretending to be Indian--reminded me to write about Satayajit Ray's 1977 classic, The Chess Players (Shatranj Ke Khilari). It is a parable of British Imperialism and Indian weakness in the year before the Siege of Lucknow became the Mutiny that drove the British East India Company out. Sanjeev Kumar and Saeed Jaffrey co-star as two chess-playing Indian notables, Mir and Mirza, who try to escape from reality through a game of strategy. Meanwhile, the British East India Company man, played by Richard Attenborough (director of Ghandi), plots a regime change in Lucknow--overthrowing a loyal but ineffectual king, Wazid Ali Shah, apparently just because he could. The film is set in the year is 1856. Indian viewers would have known that on July 11th, 1857, the Indian sepoys at Lucknow mutineed, turning on the British. The chess game went on, and on, and goes on still today...

For a genuine Indian film, it's The Chess Players over Slumdog every time....

The Iraq War Is Over

I've seen this movie before, when President Nixon began troop withdrawals from Vietnam. It doesn't end prettily, IMHO. On the other hand, no one has come up with a better idea, so it may be inevitable. Defeat in Vietnam led to a collapsed American economy that didn't recover until Ronald Reagan decided to win the Cold War. I believe the economy is linked to the war. When America is losing wars, our economy suffers. When we won the Cold War, the economy benefitted.

So, if Obama reprises the Nixon and Carter eras, it's going to be a long four years. He might get away with losing Iraq if he really wins Afghanistan...but if America is driven out of Kabul in disgrace, IMHO it means a Republican landslide in 2010, and a Republican in the White House in 2012.

So, if Obama reprises the Nixon and Carter eras, it's going to be a long four years. He might get away with losing Iraq if he really wins Afghanistan...but if America is driven out of Kabul in disgrace, IMHO it means a Republican landslide in 2010, and a Republican in the White House in 2012.

Thursday, February 26, 2009

A Russian View of America's Financial Crisis

Sergei Karaganov's "The World Crisis – A Time for Creation" reads a bit like it might have been penned by Henry Kissinger, IMHO:

AND HERE COMES THE CRISIS

Back in late August it seemed that the political semi-farcical Cold War – unleashed by the United States and its allies and clients in Eastern Europe and in Britain and which many Old Europeans met with caution but also with sympathy – would be the main political trend for the next two to three years.

But then the global financial crisis broke out, which is now being followed by a global economic crisis. I think the United States and the Old West will now have other things on their minds than conducting a Cold War.

The acute crisis has forced countries to start correcting the entire system of global economic governance. The United States and its ideas of the superiority of liberal capitalism and the limited role of the state in the economy have been dealt a severe blow. Faced with a possible severe depression, comparable to the crisis of the late 1920s-1930s, Washington has decided to nationalize failed system-forming financial companies and banks and to invest hundreds of billions of dollars in the economy. This policy is directly opposite to the Washington Consensus ideology, which was so confidently imposed in recent decades on other countries, including Russia. True liberals should have let bankrupt enterprises and the bankrupt policy fail completely and should have made room for the sprouts of a new economy. The U.S. has been followed by other countries in resorting to “socialist” methods to save failed companies and banks.

Reasonable apprehensions have already been expressed that the retreat from the former ideology of super-liberalism may go too far toward an increased state interference and may make the Western economy even less competitive. (I wish these warnings were first heeded by Russia, which is successfully destroying its competitiveness by quasi-socialist and reckless increases of labor costs and by the massive interference of corrupt state capitalism.)

Meanwhile, the International Monetary Fund, the World Bank and even the financial G7 remain silent, although the crisis had been ripening for quite some time. Only Europeans are trying to act jointly, albeit inconsistently and with unknown results.

CONCLUSIONS FOR ALL AND FOR RUSSIA

It is clear that the global crisis is only beginning and will affect everyone. But it is not clear how and when all countries will jointly start overcoming it.

But we should already sum up the preliminary results of the recent developments.

The period from August to October 2008 will likely go down in history as the start of the fourth stage in the world’s development over the past century, which began – really, not according to the calendar – in August 1914, closing the door on the splendid 19th century and ushering in the savage and revolutionary 20th century. Actually, the 21st century is beginning right now. (This idea is not mine, but that of Thierry de Montbrial, the founder of the Evian Forum and an outstanding French political thinker.)

This crisis and this new period in world history threaten to inflict inevitable hardships on billions of people, including Russians. Coupled with the aforementioned rapid geopolitical changes, with the collapse of the former system of international law and security systems, and with attempts by the weakening “elders” to stop the redistribution of forces not in their favor, this period may bring a dramatic destabilization of the international situation and an increased risk of conflicts. I would have dared to describe it as a pre-war situation and compare it with August 1914, but for one factor: huge arsenals of nuclear weapons remain, along with their deterrent factor, which makes politicians more civilized. Yet one must keep in mind the objective growth of military danger anyway.

The world economic crisis will fix the new redistribution of forces. But it can also change its speed. When the U.S. overcomes the crisis, it will end up with even less moral and political capital. I do not think that Barack Obama, now viewed as a ray of hope for America, would be able to quickly restore this capital as president. Quite possibly, the crisis will inflict even more economic damage on new industrial giants, especially at first. External markets, on which their growth largely depends, will shrink. The super-fat years will come to an end for oil producing countries, as well, including Russia, which has proved reluctant or unable to switch to a new economy and renovate its infrastructure.

The matter at hand is not just a deep financial and economic crisis. This is an overall crisis of the entire system of global governance; a crisis of ideas on which global development was based; and a crisis of international institutions.

Overcoming this overall crisis will require a new round of reforms, the construction of international institutions and systems for governing the world economy and finance, and a new philosophy for global development.

This crisis will clear out what has been artificially preserved or not reformed since the end of the Cold War. A new global governance system will have to be built on the ruins of the old one.

The time will come for creation.

When this overall crisis is over, its relative beneficiaries will include not only countries that will have been less affected by it, but also those that will have seized the initiative in building a new world order and new institutions. They will have to correspond to the emerging balance of forces and effectively respond to new challenges.

One must be morally and politically ready for that period of creation, and already now, despite the crisis, one must start building up one’s intellectual potential so that in a year or several years one could be ready to put forward one’s own, well-grounded proposals for rebuilding the international governance system on a more just and stable basis.

Russia has so far proposed a very modest plan for rebuilding the European security system and supported, at last, the idea to establish a new Concert of Nations as an association of not seven to eight old countries, but 14 to 20 of the most powerful and responsible states capable of assuming responsibility for global governance.

We need to go further and start thinking about the future already now – however difficult this might be during a crisis.

I would propose for discussion some principles for building the future system:

– Not boundless and irresponsible liberalism, but support for free trade and a liberal economic order coupled with basically stricter international regulation.

– Joint elaboration and coordination of policies by the most powerful and responsible countries, rather than attempts to establish hegemony by one country, or a struggle of all against all.

– Collective efforts to fill the security vacuum, rather than create new dividing lines and sources of conflict.

– Joint solution of energy problems, rather than artificial politicization of the energy security problem.

– Renunciation of the recognition of a nation’s right to self-determination up to secession if this is done by force. (The wave of fragmenting countries, which began in the 1950s and which received a fresh impetus with the recognition of the independence of Kosovo, South Ossetia and Abkhazia, must be stopped.)

– Russia and the European Union must strive not for a strategic partnership in their relations, but for a strategic alliance.

– The goal of development must be progress, not democracy. Democracy is a consequence and an instrument of progress.

Surely, many of the proposed principles will be objected to and rejected. But the habitual politically correct cliches will not help to improve the situation and build a new world. Meanwhile, the time is coming for creation.

John LeBoutillier on Obama's Speech to Congress

From Boot's Blasts:

• Our new President is a nice guy. The more he loosens up and relaxes himself - and smiles that huge and friendly and sincere smile - the more time he buys himself to cope with these cascading fiscal and banking problems;

• Because he fought for the Stimulus Plan and the Republicans did not join him, the economy now becomes Obama’s sooner than if the GOP was a part of it. In other words, Obama took ownership once his own prescription and protocols were implemented; blaming G.W. Bush won’t last much past this year.

• That is not to say that the Republicans escape the consequences of the ongoing financial meltdown; in fact, they have the blame painted all over them. And this taint will last for years to come.

• The GOP brand has lost its one-time luster as the party better able to cope with fiscal and national security matters. It will take years to get that special mantle back - if we can ever get it back.

• The Obama Administration is going to have more trouble with their fellow Democrats up on the Hill than they are with the Republicans. Yes, that is true. The GOP is - for the next 2 years anyway - almost completely inconsequential; but the leftist Democrats are feeling their oats and will soon want to move ever farther to the Left than Obama.

• Thus a new tension will soon arise - between these long-time House and Senate bulls who have been waiting for years to have un-checked power - and the Obama Administration which will soon realize their agenda is too much, too soon.

• Barack Obama is spending all his political capital now; he is speaking and travelling at a furious rate for a new president. Indeed, he does risk wearing out his welcome and suffering overexposure. At some point the public gets sick of the same speech over and over again and they begin to tune it out.

• Already the polling shows his numbers among Republicans falling quickly (to be expected) and among Independents to be slightly eroding (somewhat worrisome for Team Obama). And the markets tank after every big speech he makes!

• After a month it is clear that Obama fancies himself as the Salesman-in-Chief - much more than a hands-on administrator who is on top of everything in the Executive Branch. We have already seen break-downs in this model in the Daschle, Richardson and Geithner vetting procedures and the lard inside the Stimulus Bill, which Obama should have written instead of having Nancy Pelosi do it.

• Everything - EVERYTHING - for the Obama Administration depends on solving the ongoing banking problem.

• It is startling that so far neither Obama nor Geithner has come up with a bold, innovative plan to fix this mess and get people feeling better about it.

• Nor has the GOP offered up anything but Nays.

• Why not this simple, bold plan: the US Government - acting as a surgeon operating on a deteriorating patient - goes to the heart of the problem: the toxic, cancerous tumors in each bank - these securitized (bad) mortgages - and cuts them out of the patients’ balance sheets. All these cancerous tumors are gathered up into one federal bank - in the model of the S&L mess of 20 years ago - and held there until their value increases.

• Presto, the banks’ balance sheets are free and clear of the debts that were inhibiting lending - (their MRIs are suddenly clean of cancer now!)

• The Federal Government holds these toxic assets for as long as it takes for the housing market to recover - which it will because there will be pent-up demand for housing in the long run. We are a growing, now-over-300 million people population - and the demand for housing will eventually drive home values up again - although maybe not back to where they have been.

• We need a bold plan like this. Instead, Team Obama is following Team Bush’s approach - and it isn’t working.

Obama's Speech & Budget Plans: Another Double

This photo on the White House website makes it look like the President is praying for something to turn up...

This photo on the White House website makes it look like the President is praying for something to turn up...President Obama's Tuesday night address to the Joint Session of Congress, like his first press conference, was a solid double. He didn't strike out, he got on base, but he didn't hit the ball out of the park. He wasn't Reaganesque, or even Clintonesque...he was Obamaesque. Which isn't necessarily a bad thing, but not quite a good thing, either.

Basically, Obama read a laundry list of government programs and promises. I liked that he said he would end no-bid contracts and stop torture, but didn't like that he didn't say he would get our money back from the no-bid contractors and demand punishment for the torturers. The problem is that while talked about holding people accountable in the future, he stayed away from holding anyone to account for creating the mess we are in now. IMHO, that's a significant problem.

Obama needs to say, not "Tell it to Joe!" but "Disgorge your ill-gotten gains!" and "Pay for your crimes!" Maybe if the perpetrators are truly contrite he could pardon them--but first, at least they need to show some remorse...for the sake of rebuilding confidence, they can't be allowed to keep laughing after they have gone to the bank with the loot--or gotten away with murder.

Why would anyone give a dime to people who haven't gone after the people who have stolen literally billions of dollars? What is needed is not bipartisanship, rather what is needed is a good house-cleaning. He might begin by ordering the SEC to re-open at once every single securities investigation closed or dropped without resolution during the Bush administration.

Unfortunately, the President talks about the need to restore confidence yet appointed a Treasury Secretary who does not, and IMHO cannot. No wonder the market continued to fall after Obama's speech. Last night's TV interview with Jim Lehrer made Geithner look like a complete dope...if it had been a job interview, Geither would have quickly heard, "Next!" The Treasury secretary couldn't give a straight answer to a single question, plus he had a supercilious smirk on his face, like he was pleased to be pulling one over on Jim Lehrer. If Obama is serious about restoring confidence, Geithner might want to decide the what he really wants to do is spend more time with his family, asap. The administration needs someone who personally inspires confidence, who has real achievements and a reputation for honesty--not a tax cheat who sounds like a C student squeaking by in an oral exam. Someone with gravitas like Paul Volcker.

Finally, Obama did not paint a "big picture" in his speech. He can't inspire without one. All the ditches and bridges and teachers and firemen and computerized medical records and tax credits in the world won't make up for it. At this point "Yes, we can" is not good enough. We already did...he's the President. Now, Obama needs some specific mission for the nation. JFK rallied America around a Mission to the Moon; Ronald Reagan, the High Frontier and Winning the Cold War; Bill Clinton, a Bridge to the 21st Century. Each stimulated the economy...the Space Race led to the communications satellites and fiber optics that made the computer age possible, as well as deterring the USSR; the defeat of the USSR led to a new birth of freedom and economic growth around the country and the world; and Clinton's high-tech revolution and commercialization of the internet (yes, spearheaded by Al Gore) created opportunities for technologies such as Google and Blogger and Twitter and iPhones and all the rest. Digging ditches and volunteering in soup kitchens and windmills isn't going to cut it, I'm afraid.

One acquaintance noted that Obama didn't even mention the space program in his talk. Yet at this moment, we are faced with challenges as great as Sputnik from China's moon shot, India's moon shot, and Iran's satellite launch. Even if these countries don't use the new technology to attack the US directly, they certainly are set up to challenge American satellite and IT dominance in war as well as peace. IMHO, Obama needs to look up into the heavens, inspiring us to reach for the stars--in addition to promoting "shovel ready" construction projects here on earth.

Unsuccessful Presidents, such as Bush 41 & 43, Gerald Ford, and Jimmy Carter, have asked us to lower our expectations preying on our fears. Successful Presidents such as JFK, Reagan, and Clinton, have led us into a brighter future, inspired by our hopes. If he wants a second term, Obama needs to give us some really big picture hopes, that create jobs and stimulate new dreams.

In the meantime, here's a link to Recovery.gov, official website of the stimulus package. And here's a link to an ACLU petition demanding that President Obama open Guantanamo Bay prison to independent public inspection.

Subscribe to:

Posts (Atom)