Reporting on General Edmund Allenby's conquest of Jerusalem on December 9, 1917, the New York Herald announced in a headline: "Jerusalem Rescued by British after 673 Years of Moslem Rule." Subtitles then elaborate: "Great Rejoicing in the Christian World" and "Jews Everywhere in Particular See the Restoration of Palestine as Part of Allies' Programme."

The math checks out: 1917-673=1244, the year when the Ayyubids, with Khwarezmian aid, seized the city for the last time from the Crusaders

The newspaper's second page boasts stories under headlines that read "Distinguished Jews Here [i.e., New York] Express Joy Over Capture of Jerusalem by British," "Rescure of Jerusalem Causes Joy," and "Holy City Ravaged in Many Wars by Pagan and Turk: Has Been Under the Yoke of Mohammedan Rule for 670 Years."

Comment: (1) The lead headline captures a mentality once dominant but now rare in the West, when there was a self-conscious "Christian world" and it rejoiced in a religious/military victory over Muslims. (2) Conversely, the "Muslim world" would still today rejoice in precisely this manner, recalling medieval rivalries, raising religious sentiments, and taking satisfaction at the humiliation of an age-old enemy. (3) If the West can travel so far in less than a century, why not Muslims as well? (March 30, 2009)

“This is slavery, not to speak one's thought.” ― Euripides, The Phoenician Women

Monday, March 30, 2009

Daniel Pipes on British Crusaders' Propaganda in 1917

From DanielPipes.org:

Robert Kuttner: Federal Reserve Has Become Slush Fund

From the Huffington Post:

Even more alarmingly, the administration is now using the Federal Reserve as an unlegislated, all-purpose slush fund. Because the Fed's operations are largely beyond the reach of Congressional appropriations or scrutiny, the Fed can do whatever it wishes with its money. The Geithner plan was negotiated behind closed doors, the main players being the Fed, the FDIC, the Treasury, and power-brokers on Wall Street.

What we have is something perilously close to a dictatorship of the Fed and the Treasury, acting in the interests of Wall Street. The contrasts with the first hundred days of the Roosevelt administration are striking. Like Roosevelt, Obama faces an economic emergency. Like Roosevelt, he faces an angry public, which has been bilked by excesses on Wall Street. And like Roosevelt, Obama has a supportive Democratic Congress that is willing to substantially defer to the White House on an emergency recovery plan.

But unlike Roosevelt, who used the public's indignation and Congress's support to constrain the barons of private finance, Obama's economic team is using government funds to put the most abusive players on Wall Street back in the saddle. And Geithner and Summers, working with the Fed, are assembling their plan with no public scrutiny.

In the course of a week, the administration's own rhetoric on the A.I.G. bonuses has shifted from "We were bound by contracts" to "This is an outrage" to "Never mind." Wall Street was out for favor for just days. Meanwhile, Geithner is out with a new proposal to give the Federal Reserve even more sweeping powers to be a "systemic risk regulator."

All of this invites a couple of hard questions.

First, was this the only way to proceed? I have addressed this in a previous column arguing that a superior approach would be a new Reconstruction Finance Corporation.

For details of a well articulated rationale for a new RFC, see the recent speech by Thomas Hoenig, president of the Federal Reserve Bank of Kansas City, whose jurisdiction covers eleven Midwestern states. (PDF)

Second, where is Congress? Basically, the key Democratic Committee chairman, whatever their private reservations, have been persuaded that they need to support their president and that the Geithner plan is worth a try. But at the very least, they should be asking harder questions and demanding more transparency. For instance, the Treasury needs to define tactics to game the bailout that will be be prohibited. Congress needs to know which Wall Street moguls the Treasury team met with, and exactly what they were promised. And the whole plan needs to be legislated, rather than made up on the fly by Summers, Geithner, and Bernanke.

At the very least, Congress should act now to cap the kind of windfall profits that hedge funds and private equity companies are likely to make with government bearing nearly all of the risk. There is a good precedent for this. During and after World War II, ending only in the early 1970s, there was a government agency called the Renegotiation Board. Defense Contractors had to agree to a contractual provision allowing a post-audit, after the contract was finished. If their profit exceed the stipulated amount, the government got a refund. By the same token, hedge fund and private equity bets made with government guarantees should have limits on their upside.

And before the Fed is turned into an even more potent all-purpose regulator, Congress should turn it into a true public institution--a reform project that has been deferred since Roosevelt's day.

At a recent conference of the New America Foundation, economist and Obama adviser Laura Tyson, an in exchange with me, defended the administration's approach on the premise that there was no way that Congress would legislate the one to two trillion dollars in public funds that will be needed to make this rescue work. So, in Tyson's view, there was no alternative other than having Treasury contrive its own plan, using the Fed as an all purpose source of unlegislated financing.

I think this is exactly backwards. The administration has, in fact, put $750 billion into its current budget for bank-bailout funds to be tapped later. And if the White House had proposed a more progressive approach to the whole financial rescue--taking failed banks into receivership, involving Congress in the program design, doing comprehensive government audits of bank balance sheets before rather than after the fact, and forcing bank shareholders and bondholders rather than taxpayers to take more of the hit--Congress might well have provided at least some of the funds, leaving the Fed to provide the rest.

Under the present arrangement, the Fed provides nearly all of the funds, an approach that carries no transparency and huge risks of its own. Until last September, the Fed bought and sold mainly Treasury bonds, the safest securities there are. And it did so for one purpose only--to conduct monetary policy. Now, the Fed is buying trillions of dollars of junk assets, and it will be under tremendous pressure to keep these on its own books, compromising its capacity to run the nation's monetary policy.

It's possible that the Geithner plan will "work" in the sense of re-starting the Wall Street bubble machine, this time with a limitless line of direct credit from the Federal Reserve. If that happens, it will defer an even more serious day of reckoning, as the cost of the Fed's immense credit creation comes due. But the greater likelihood is that the plan will merely enrich some speculators, but neither bring zombie banks back to life, nor get a normal banking and credit system operating again. And then the administration will need to come back to Congress, this time with less credibility, with the economy in even worse shape, having burned through more than a trillion dollars.

We were promised unprecedented openness. In the most momentous area of policy for getting the economy functioning again for ordinary Americans, we have instead unprecedented secrecy, designed by and for Wall Street. We expected better of Obama.

FoxNation Blog Debuts

So far, it looks like a conservative version of The Huffington Post, IMHO...meanwhile you can read Rupert Murdoch's latest venture for yourself here: http://www.thefoxnation.com/.

I Liked Little Dorrit...

...on Masterpiece Theatre last night, although some of the direction was a little too dark and grotesque (I prefer a lighter touch with Dickens). It was nice to hear someone say "a cup of tea," see those carriages, hear those hooves clip-clopping, and have a soothing evening's entertainment of classic serial drama. Lead actors were good, Tom Courtenay outstanding. Glad it's back on Sunday night at 9 pm. Looking forward to next week.

Now, if only WGBH and PBS could find someone to sit calmly in a leather armchair with a book, instead of Laura Linney hyperventilating while standing in front of a scrim... Perhaps Christopher Hitchens might be available?

Meanwhile, here's the BBC preview:

Now, if only WGBH and PBS could find someone to sit calmly in a leather armchair with a book, instead of Laura Linney hyperventilating while standing in front of a scrim... Perhaps Christopher Hitchens might be available?

Meanwhile, here's the BBC preview:

Jonathan Jones: How Art Killed Our Culture

Someone I know sent me a link to this interesting article from The Guardian (UK) blog:

No sphere of high culture is implicated in the fall of the affluent society in the same way art is. Yesterday I commented on the resistance to melancholy, the flight from reality, that enabled art in our time to promote the fantasy of an unlimited market. Some have called the system that has now fallen "offshore capitalism"; perhaps another description is "post-modern capitalism". In post-modern capitalism, secondary markets created a counter-reality that was unfettered by production. The economy was run like a theme park. It's obvious how deeply involved in that daydream was the art of the last 20 years, which so gleefully rejected anything that might tie it to the slow, patient, tedious stuff of real creativity.

Drama, the novel, even cinema have all kept a safer distance from the booming monster of modern capitalism than artists did. What I want to ask now is – why? What happened? How did art become the mirror of fraud? It is not a story that starts with Damien Hirst's diamond skull but one that goes back to the very origins of the consumer society.

After the second world war artists were steeped in history and introspection. Art has never been more serious in its view of life than it was in the era of Mark Rothko and Francis Bacon. But even as modern painting reached such heights and depths, western society was going through an epochal transformation. The power of the capitalist economies in the postwar era was unprecedented in world history. An entirely new lifestyle, that of "consumerism", was born.

Consumerism instantly inspired artists. Pop art in America and Britain took the surfaces of objects, the instant appearances of the new bright world, as its subject matter. Everywhere, emotional depth in art was censored. Abstract Expressionism had to die. Art could teach people to look at the world in a new way: to embrace the cool. Pop art taught everyone to enjoy money and the mass media and 1980s post-modernism taught the same lesson again.

These emotional styles have long since been so popularised that even intelligent people accept that reality television is a form of culture and celebrities fit receptacles for our ephemeral floods of feeling. All the shallowness of modern mass culture began in avant-garde art 40 years ago. We're Warhol's ugly brood. Art has even fed the unsustainable appetites that are destroying the planet by constantly telling everyone cities are better than the countryside, culture more real than nature. It has become the enemy of truth, the murderer of decency.

The modern world has screwed itself and art led the way.

Thursday, March 26, 2009

Amil Imani: Safeguarding Cyrus the Great Cylinder

Amil Imani asked me to pass the word on protecting the Cyrus the Great Cylinder:

Please Sign-Safeguarding Cyrus the Great Cylinder

Tuesday, 24 March 2009

To: UNESCO World Heritage, the British Government, the British Museum, International media, and all organizations and individuals concerned with preservation of humanity’s precious treasures

The British Museum is planning to lend the Islamic Republic in April, one of the most precious antiquities in the world, Cyrus the Great Cylinder. The Cyrus Cylinder has been hailed as the first charter of human rights. In 1971, in recognition of the unique nature of this artifact, the United Nations produced a translation of it in all the UN official languages.

A vast number of Iranians are deeply concerned about the fate of the Cyrus Cylinder, should it be loaned to the Islamists presently ruling Iran. The hostility of the clerical regime of Iran toward anything and everything Iranian that predates Islam is a well-documented fact. This priceless artifact belongs to Iran. Entrusting it to the hands of the sworn enemies of Iranian heritage entails an unacceptably high risk. It is imperative that the British authorities rescind the decision and take every measure to insure that the Cyrus Cylinder is preserved safely and returned to its rightful owner Iran only after the demise of the Islamic Republic.

The Islamic Republic of Iran is staffed by diehard elements that are determined to wipe out all traces of the pre-Islamic era. They aim to surpass the heinous act of Afghanistan's Taliban who destroyed the irreplaceable two Buddha statues. What is enshrined in the Cyrus Cylinder is unconditional respect for the complete rights of all the people of the world, an anathema to the Islamists' credo.

The current Islamic regime under the mullahs has shown, on numberless occasions, its contempt both in words and action for the memory of Cyrus, including flooding the plain which houses Cyrus’s tomb, destroying the archeological sites of Pasargad and Persepolis, and harassing and intimidating those who would gather at the tomb of enlightened king to commemorate the International Day of Cyrus the Great.

It is with great apprehension that the Iranian people warn Mr. Andrew Murray Burnham, the British Secretary of State for culture, as well as the British government regarding the plan to lend this precious treasure of humanity to a contemptuous cult of medieval mullahs.

Furthermore, it is urgent that UNESCO take the additional step of immediately registering Cyrus’s Charter of Human Rights Cylinder in its World Heritage Memory, in order to safeguard the diverse cultural heritage of the peoples of the world.

Sincerely,

The Undersigned

Tuesday, March 17, 2009

No Wonder Newspapers Are Dying...

Michael Calderone, writing in Politico, explains the vast left-wing conspiracy that has made all newspapers sound the same--it's called JournoList:

Said another JLister: “I don’t know any other place where working journalists, policy wonks and academics who write about current politics and political history routinely communicate with one another.”

But what if all the private exchanges got leaked?

That’s been the subject of some JList conversation, too, as members discuss the Weekly Standard’s publication of a 2006 e-mail posted to the private China Security Listserv by diplomat Charles Freeman, who last week withdrew his name from consideration for a top intelligence job.

Michael Goldfarb, a former McCain staffer and conservative blogger who published the e-mail, was not part of the China list and therefore hadn’t agreed to any off-the-record rules.

Asked about the existence of conservative listservs, Goldfarb said they’re much less prevalent.

“There is nothing comparable on the right. E-mail conversations among bloggers, journalists and experts on our side tend to be ad hoc,” Goldfarb said. “The JournoList thing always struck me as a little creepy.”

Kaus, too, has seemed put off by the whole idea, once talking on BloggingHeads about how the list “seems contrary to the spirit of the Web.”

“You don’t want to create a whole separate, like, private blog that only the elite bloggers can go into, and then what you present to the public is sort of the propaganda you’ve decided to go public with,” Kaus argued.

But Time’s Joe Klein, who acknowledged being on JList and several other listservs, said in an e-mail that “they’re valuable in the way that candid conversations with colleagues and experts always are.” Defending the off-the-record rule, Klein said that “candor is essential and can only be guaranteed by keeping these conversations private.”

And then Klein — speaking like the JLister he is — said there wasn’t “anything more that I can or want to say about the subject.”

Why Irish Eyes Are Smiling...

WASHINGTON (AP) — The White House is going green for St. Patrick's Day.BTW, President Obama is Irish:

The water in the fountains on the north and south lawns of the White House has been dyed green to mark the national holiday of Ireland.

First Lady Michelle Obama came up with the idea for the festive touch, said spokeswoman Katie McCormick Lelyveld. She was inspired by the St. Patrick's Day celebrations in her hometown of Chicago, where the city marks the holiday by dyeing the river green.

"It's a little piece of home for our new home," said Lelyveld, who is also from Chicago.

Lelyveld said it's the first time the water in the White House fountains has been dyed. The green hue will stay until the dye runs outs.

President Barack Obama marks St. Patrick's Day with separate meetings in Washington with Irish leaders and he'll also attend St. Patrick's Day events in the White House and on Capitol Hill.

Now, before I turn it over to the Taoiseach, it turns out that we have something in common. He hails from County Offaly. [Note: "King's County" before 1922] And it was brought to my attention on the campaign that my great-great-great grandfather on my mother's side came to America from a small village in County Offaly, as well. We are still speculating on whether we are related. (Laughter.)

I do share, though, a deep appreciation for the remarkable ties between our nations. I am grateful to him for his leadership of Ireland. The bond between our countries could not be stronger. As somebody who comes from Chicago, I know a little bit about Ireland, and the warmth, the good humor, and the fierce passion and intelligence of the Irish people is something that has informed our own culture, as well. And so that's why this day and this celebration is so important.

Monday, March 16, 2009

Ali Alyami's Letter to the Washington Post

Received by email this weekend:

While reasonable people can understand and empathize with President Obama’s efforts to address the gargantuan economic problems he is facing at home and abroad, compromising our moral and democratic values (Moralism on the Shelf, the Post March 10, 2009; A13) is not only myopic, but will grant victories to those who are bent on rendering America politically, morally and economically irrelevant. We are already dependent on two of the world most tyrannical regimes, the Saudi ruling family and the Beijing Communist party, for our economic survival. Under these humbling conditions, how long we will be able to maintain our democratic values. In addition, by abandoning our moral and democratic values, we will demoralize most of the world’s population who looks up to this country for liberation from their oppressive ruling elites. The price for risky and ill advised short cuts to solve long term problems can be very high in material, security and democratic values that made America what it is, the envy of the world.

Ali H. Alyami, Ph. D.

Executive Director, The Center for Democracy and Human Rights in Saudi Arabia

1050 17 St. NW Suite 1000

Washington, DC 20036

Tel: (202) 558-5552; (202) 413-0084; Fax: (202) 536-5210

ali@cdhr.info; www.cdhr.info

Roger Simon on Roger Cohen's Love Affair With Teheran

Roger Simon went to see Roger Cohen speak to Iranian Jewish exiles at LA's Temple Sinai and filed this report:

I was puzzled by Cohen’s strange reaction to Iran until an audience member asked a question about the notorious public hangings in that country. Astonishingly, Cohen muttered something under his breath about us killing people in Texas. Now as someone who opposes capital punishment I can say this: Anyone who sees even remote moral equivalence between a culture that executes convicted murderers after appeal and one that hangs homosexuals for their sexual preference and stones women to death for adultery has, to be kind, a rather bizarre world view. This is cultural relativism run amuck.Video feed available from the Jewish Journal of Los Angeles, here.

It’s hard to like someone who makes statements like that and it’s hard to give his opinions much credence. Nevertheless, what Cohen apparently derived from his visit is that Iran is a complex society (whoever thought it wasn’t?) and that we should be negotiating with their government. When asked by another audience member what he made of the years of failed negotiations with the European Union, he dismissed them out of hand. The Europeans have no army. We are the big guys.

Again, no mention of the obvious - that we and, of course, the Iranians knew full well that the Euros were representing us and that at the slightest hint of a concession we would have come running to the table, just as we had with the North Koreans. Moreover, we have already been holding limited negotiations with the Iranians in Iraq for some time and, I would bet my house, have been holding back channel negotiations with them for years. As most of us, and I assume Cohen, know – almost all significant discussions of this nature go on out sight.

Still, I have no argument against negotiation. The only harm is that it buys the Iranians time to continue building an atomic bomb. This does not overly alarm Cohen who believes the mullahs to be pragmatists. He doesn’t seem disturbed by their eschatology or, I guess, really thinks they believe it. I assume he knows about it, although he did not demonstrate any background or interest in this area. That fundamentalist belief system, however, does concern me. It wasn’t that long ago (1980s) that Ayatollah Khomeini drove hundreds or thousands of ten-year old boys to their deaths as human mine sweepers for the greater glory of the Mahdi (to bring forth the hidden Imam – a form of Shia messiah). These are not exactly the people you would like to have a nuclear weapon.

Robert Kuttner on the AIG Scandal

From the Huffington Post:

But the outrage over the AIG bonuses is a sideshow. The larger problem, both financially and politically, is the entire strategy for rescuing the banks.

It would be hard to imagine two administrations seemingly more opposite than the Bush and the Obama presidencies. Yet Geithner's approach is essentially a continuation of the failed strategy of Bush Treasury Secretary Henry Paulson, Geithner's former close colleague in Geithner's prior role as president of the New York Fed.

In defending the AIG bonuses, CEO Edward Liddy actually said that you had to pay bonuses to attract and keep "the best and brightest talent," in this case the very people who are costing America's taxpayers $175 billion and counting. Far from receiving bonuses, these people deserve to share a cell with Bernie Madoff.

By the same token, Larry Summers and Tim Geithner are not the only smart people about finance. If President Obama wants a second opinion, he could begin with Paul Volcker, nominally chairman of Obama's own "Economic Recovery Advisory Board," which so far is mainly window-dressing. According to my sources, Summers and Geithner seldom talk to Volcker because they don't like Volcker's criticisms of their plan.

The president could also consult with several people in the Federal Reserve System who have a different view, and also the FDIC leadership, and the Congressional Oversight Panel that was created by Congress as the precondition for appropriating the TARP money. The panel has the statutory right to get documents from the Treasury. But under Geithner as under Paulson before him, Treasury has been stonewalling. Legislators of both parties are increasingly viewing Geithner as part of the problem.

As the administration continues its coziness with Wall Street and the approach fails to bring zombie banks back to life, populist anger passes to both the Republicans and to media tribunes such as Lou Dobbs. This brand of populism is one part anti-Wall Street, but two parts anti-government and anti-immigrant. It has no strategic coherence as a recovery plan.

The alternative to Lou Dobbs' brand of populism is of course Franklin Roosevelt's. But something is really off when Sen. Sam Brownback, the AEI, and the Kansas City Federal Reserve Bank start sounding more like Roosevelt than Barack Obama's treasury secretary does.

Obama needs to get a second opinion, firsthand.

Sunday, March 15, 2009

To End Financial Crisis, Cancel All Credit Default Swaps

(ht Daily Kos) The so-called credit default swaps were fraudulent wagers that should be declared null and void as gambling debts, and therefore unenforcable. In fact, Congress acted in 2000--during the Clinton administration, thanks to help from the likes of Senate Finance Committee Chairman Chris Dodd--to exempt such wagers from existing state gambling law. The obvious solution is to rescind that 2000 legislation and treat credit default swap debt as illegal gambling (which it clearly was, given the results). As explained by Moon of Alabama, Sept. 21, 2008, there is a precedent from the Great Depression era:

At the bottom of the inverted financial pyramid are overvalued land, wood structures, dry walls and granite countertops - i.e. cheaply over-build houses.

These were sold to people who could only afford them with mortgages that had unrealistic starting conditions and on the premise that housing prices would continue to rise forever.

These mortgages were bundled, sliced and diced into Mortgage Backed Securities and sold to investors. Home equity loans, car-loans and credit card debt were converted to Asset Backed Securities and sold off.

On top of these MBS/ABS papers some geniuses constructed an additional financial layer.

These were insurance contracts that covered against the default of ABS, MBS and various types of bonds. These insurance contracts, Credit Default Swaps, are totally unregulated private agreements. They were widely created and dealt with when the risk of default of the underlying papers was assumed to be low.

Some of the insurers who issued these CDS never had the capital to back all the policies they wrote. In a competitive environment they offered too low premiums to insure against default risks.

Some insurers partly insured themselves via reinsurance. When they sold a CDS on a bond issue of some $10 million they went to other insurers and bought themselves CDS, let's say $5 million or perhaps even for $20 million. The re-insurers partly re-insured themselves again by buying CDS elsewhere.

Some people simply betted on a change in the default risk of some bonds. They did not even own the MBS or bond in question, but bought or sold insurance against the default of a specific MBS or bond anyway. Some may have bought total insurance from different insurers in a way that a default of the MBS would pay them ten times the nominal value of said MBS.

Imagine you could have ten fire insurances on your home that would each pay out the full value of your house if it burns down. That would probably give you some very hot ideas.

That is exactly the reason why fire insurance regulation prevents such a case. But CDS are unregulated, their originators are unregulated and there is no settlement mechanism for them other than the private contracts between the parties.

The original size of the mortgages going into default are probably $300-500 billion. The total mortgage origination in the last years were a few trillion dollars. These and additionally credit card loans and auto loans that were converted to Asset Backed Securities in a volume of about $6 trillion.

But on top of these $6 trillion of MBS/ABS and bonds insurances, re-insurances and re-re-insurances were written with an estimated total nominal value of some $65+ trillion. The real number is unknown, but it is bigger than the whole worlds yearly GDP.

Now the housing bubble busted. There was simply too much supply created to sustain ever rising prices. Without rising house prices a lot of homeowners had to default on their mortgages.

With the mortgages going into foreclosure, the MBS and other asset backed papers where suddenly less worth than expected. This triggered credit insurance events. People who had bought the Credit Default Swaps suddenly demanded money from their insurers.

It turns out that these insurers, or their re-insurers, or whoever meanwhile carries the now negative side of the CDS in question are out of money and the insurance agreements are worthless. The worlds biggest insurer, AIG, was nationalized because it had written too much credit insurance for too low prices.

The big danger now are not defaulting homeowners. The big danger are not Asset Backed Securities that might lose some value.

The big danger is the pyramid of credit insurances that is certain to come down and that will take with it at least half of the existing finance infrastructure.

Banks, hedge funds, pension funds, municipals and others who bought insurance will find that it is worthless. Banks, hedge funds an others who sold insurances will find that they will have to pay out more than their total capital.

We currently see a credit-freeze because nobody wants to lend to anybody as it is impossible to know how much credit insurance the other party has written or how much it depends on their validity. You do not lend to anyone who might already be bust.

That is the situation we are in and it shows why the Paulson plan is utter crap and nothing but a huge robbery.

The Paulson plan would not help at the bottom of the inverted pyramid, the housing market, and not at the top, in the CDS market.

Paulson knows that the crash of the CDS market is inevitable. His plan is an attempt to let the taxpayer pay for the stabilization of the middle of the pyramid in the hope that the big crash will come only after the election (and in the hope that the loot might help Paulson's beloved Goldman Sachs to survive.)

There is only way to avert the crash.

Declare all CDS contracts, worldwide, as null and void. There is precedence for this:

During the Great Depression, many debt contracts were indexed to gold. So when the dollar convertibility into gold was suspended, the value of that debt soared, threatening the survival of many institutions. The Roosevelt Administration declared the clause invalid, de facto forcing debt forgiveness. Furthermore, the Supreme Court maintained this decision.

The maze of the value and ownership of $65+ trillion of financial credit insurance contracts has frozen the credit markets. Nobody is lending to anybody else because the value of the counterparty is in doubt.

Those $65 trillion reasons for the credit market freeze will never go away without a huge crash that then will have worth consequences than the 1929 stock market crash. The only way to eliminate these reasons is internationally concerted action to declare the legal obligations of all CDS' null and void.

At the same time:

Friday, March 13, 2009

Jon Stewart v Jim Cramer

(ht drudge/breitbart)

For more, see What We Should Learn From Jim Cramer vs The Daily Show's Jon Stewart by Patrick Byrne on DeepCapture Blog

Time to re-open the SEC investigation into allegations that Cramer engaged in stock manipulation quashed by former SEC chairman Chris Cox?

For more, see What We Should Learn From Jim Cramer vs The Daily Show's Jon Stewart by Patrick Byrne on DeepCapture Blog

Time to re-open the SEC investigation into allegations that Cramer engaged in stock manipulation quashed by former SEC chairman Chris Cox?

Thursday, March 12, 2009

The Washington Post on Chas Freeman's Withdrawal

From today's Washington Post:

BTW, I hope someone is looking into a replacement for Director of National Intelligence Dennis Blair. His handling of this nomination was unbelievably stupid. I don't care if he did go to Oxford as a Rhodes Scholar and is a classmate of Bill Clinton. Political analysis is one of the jobs of an intelligence analyst--and he failed his first important test. The nation can't afford to have someone politically dumb as Blair, as DNI.

Blame the 'Lobby'IMHO, Freeman's self-serving and misleading statement is evidence enough that he was the wrong pick for head of the National Intelligence Council...let alone obvious questions of possible personal financial obligation to Saudi Arabia and/or China, among others, through NGOs and businesses dependent on government favors. Even if he were a "double agent," how could Americans ever be sure who's side he really was on? Patriotism is the last refuge of a scoundrel...the next-to-last: Blaming the Jews.

The Obama administration's latest failed nominee peddles a conspiracy theory.

FORMER ambassador Charles W. Freeman Jr. looked like a poor choice to chair the Obama administration's National Intelligence Council. A former envoy to Saudi Arabia and China, he suffered from an extreme case of clientitis on both accounts. In addition to chiding Beijing for not crushing the Tiananmen Square democracy protests sooner and offering sycophantic paeans to Saudi King "Abdullah the Great," Mr. Freeman headed a Saudi-funded Middle East advocacy group in Washington and served on the advisory board of a state-owned Chinese oil company. It was only reasonable to ask -- as numerous members of Congress had begun to do -- whether such an actor was the right person to oversee the preparation of National Intelligence Estimates.

It wasn't until Mr. Freeman withdrew from consideration for the job, however, that it became clear just how bad a selection Director of National Intelligence Dennis C. Blair had made. Mr. Freeman issued a two-page screed on Tuesday in which he described himself as the victim of a shadowy and sinister "Lobby" whose "tactics plumb the depths of dishonor and indecency" and which is "intent on enforcing adherence to the policies of a foreign government." Yes, Mr. Freeman was referring to Americans who support Israel -- and his statement was a grotesque libel.

For the record, the American Israel Public Affairs Committee says that it took no formal position on Mr. Freeman's appointment and undertook no lobbying against him. If there was a campaign, its leaders didn't bother to contact the Post editorial board. According to a report by Newsweek, Mr. Freeman's most formidable critic -- House Speaker Nancy Pelosi -- was incensed by his position on dissent in China.

But let's consider the ambassador's broader charge: He describes "an inability of the American public to discuss, or the government to consider, any option for U.S. policies in the Middle East opposed by the ruling faction in Israeli politics." That will certainly be news to Israel's "ruling faction," which in the past few years alone has seen the U.S. government promote a Palestinian election that it opposed; refuse it weapons it might have used for an attack on Iran's nuclear facilities; and adopt a policy of direct negotiations with a regime that denies the Holocaust and that promises to wipe Israel off the map. Two Israeli governments have been forced from office since the early 1990s after open clashes with Washington over matters such as settlement construction in the occupied territories.

What's striking about the charges by Mr. Freeman and like-minded conspiracy theorists is their blatant disregard for such established facts. Mr. Freeman darkly claims that "it is not permitted for anyone in the United States" to describe Israel's nefarious influence. But several of his allies have made themselves famous (and advanced their careers) by making such charges -- and no doubt Mr. Freeman himself will now win plenty of admiring attention. Crackpot tirades such as his have always had an eager audience here and around the world. The real question is why an administration that says it aims to depoliticize U.S. intelligence estimates would have chosen such a man to oversee them.

BTW, I hope someone is looking into a replacement for Director of National Intelligence Dennis Blair. His handling of this nomination was unbelievably stupid. I don't care if he did go to Oxford as a Rhodes Scholar and is a classmate of Bill Clinton. Political analysis is one of the jobs of an intelligence analyst--and he failed his first important test. The nation can't afford to have someone politically dumb as Blair, as DNI.

Tuesday, March 10, 2009

You Can Believe This Article In Today's Salt Lake Tribune:

Headline: Jews celebrate Purim with hamantaschen:

The Jewish holiday of Purim is not as well-known as Hanukah or Passover, but the late-winter celebration is just as much fun. This year it falls on March 10.Hag Sameach!

Children wear costumes and listen to stories. Adults sip wine and everyone eats hamantaschen, buttery shortbread cookies usually filled with fruit preserves, nuts and spices or poppy seeds

Haman's pockets, as they are sometimes called, were brought to America by Jews from the eastern part of Germany and Eastern Europe, cookbook author Joan Nathan notes in Jewish Cooking in America .

"Hamantaschen are so popular that many academic institutions hold an annual hamantaschen vs. latke debate," she notes.

Monday, March 09, 2009

Daily Telegraph (UK): USAID Killed Zimbabwe Opposition Leader's Wife

In the US, if this Telegraph story is true, and the US Agency for International Development paid for the truck that killed Mrs. Tsvanirai, Morgan Tsvangirai's attorneys might be able to sue the US government for negligent homicide in an American court. In any case, I hope the US Congress and Obama administration look into the question of USAID's responsibility (as well as the British development agency mentioned) for this tragedy:

Mrs Tsvangirai, 50, died at the scene of the accident, on the main road leading south from the capital. Her husband is said to be "very devastated" by her death.

MDC party officials have called for an investigation into the circumstances of the crash, at 4pm on Friday. The couple's Toyota Landcruiser rolled three times after it was hit by a lorry which is understood to have swerved into their path to avoid a pothole.

ABC News in the United States cited unnamed US officials as saying the truck belonged to a contractor working for the US and British governments.

The truck, which had a USAID insignia on it, was purchased by US government funds and its driver was hired by a British development agency, the report said. USAID stands for the US Agency for International Development.

State media in Zimbabwe had earlier reported that the lorry involved in the incident belonged to the US government aid organisation, USAID, and was carrying Aids medicines to Harare. A US Embassy official in the capital confirmed that the vehicle had been contracted to USAID.

Piccolo Art

At the DC Spring Antiques Show yesterday, someone I know happened on a 19th century watercolor at a stand called Piccoloart. When our small group of visitors descended, proprietor Nancy Christman Reilly was so charming--even reciting a stanza from Robert Burns's Address To A Haggis in front of portraits featuring two tartan-clad worthies--that we bought three smaller 19th century pictures right off the wall. The mom-and-pop Reillys hail from Ohio, spent years in England, Nancy trained at Sotheby's, and they now live and work in Edenton, North Carolina, of all places...If you are interested in British portraits and miniatures--or the poetry of Robert Burns--the DC Spring Antiques Show is open today until 6 pm at the Washington Convention Center.

Saturday, March 07, 2009

Happy International Women's Day!

Here's a link to the official webpage for March 8th, my favorite holiday in the former USSR. BTW, they seem to have some corporate sponsors nowadays--including HSBC, Skype, and Cisco Systems.

IMHO, Maybe President Obama could add the US to the list of nation's that celebrate women? We need all the holidays we can get, in these troubled economic times...

IMHO, Maybe President Obama could add the US to the list of nation's that celebrate women? We need all the holidays we can get, in these troubled economic times...

Monday, March 02, 2009

Peter Schiff on the Perils of Obama's Economic Strategy

From the website of an economic forecaster who predicted Wall Street's meltdown:

The existence of credit in no way increases aggregate consumption within this community, it merely temporarily alters the way consumption is distributed. The only way for aggregate consumption to increase is for the production of candlesticks, steak, and bread to increase.

One way credit could be used to grow this economy would be for the candlestick maker to borrow bread and steak for sustenance while he improves the productive capacity of his candlestick-making equipment. If successful, he could repay his loans with interest out of his increased production, and all would benefit from greater productivity. In this case the under-consumption of the butcher and baker led to the accumulation of savings, which were then loaned to the candlestick maker to finance capital investments. Had the butcher and baker consumed all their production, no savings would have been accumulated, and no credit would have been available to the candlestick maker, depriving society of the increased productivity that would have followed.

On the other hand, had the candlestick maker merely borrowed bread and steak to sustain himself while taking a vacation from candlestick making, society would gain nothing, and there would be a good chance the candlestick maker would default on the loan. In this case, the extension of consumer credit squanders savings which are now no longer available to finance other capital investments.

What would happen if a natural disaster destroyed all the equipment used to make candlesticks, bread and steak? Confronted with dangerous shortages of food and lighting, Barack Obama would offer to stimulate the economy by handing out pieces of paper called money and guaranteeing loans to whomever wants to consume. What good would the money do? Would these pieces of paper or loans make goods magically appear?

The mere introduction of paper money into this economy only increases the ability of the butcher, baker, and candlestick maker to bid up prices (measured in money, not trade goods) once goods are actually produced again. The only way to restore actual prosperity is to repair the destroyed equipment and start producing again.

The sad truth is that the productive capacity of the American economy is now largely in tatters. Our industrial economy has been replaced by a reliance on health care, financial services and government spending. Introducing freer flowing credit and more printed money into such a system will do nothing except spark inflation. We need to get back to the basics of production. It won’t be easy, but it will work.

President Obama would have us believe that we can all spend the day relaxing in a tub while his printing press does all the work for us. The problem comes when you get out of the tub to go to dinner and the only thing on your plate is an IOU for steak.

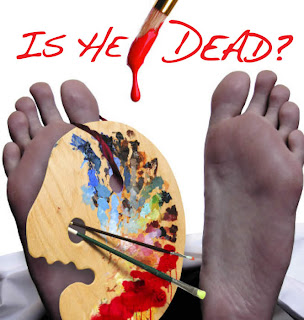

Mark Twain's Is He Dead? at the Olney Theatre

Olney Theatre's Saturday matinee production of Mark Twain's Is He Dead? (through March 8th) was a delight. Mark Twain's view of the European art world, written when he lived in Vienna! What could be better than that? Not cornpone, but cosmopolitan, Mark Twain...in a production of a charming, laugh-out-loud farce. And one of the the first jokes was about a bank collapse.

A brief internet search revealed the show played on Broadway in 2008, directed by Michael Blakemore. The manuscript, discovered by Shelly Fisher Fishkin, has been published as by the University of California Press. And a review by Mark Dawidziak, on Twainweb.net, explains why it is so worthwhile:

First and foremost, Is He Dead? must be considered an important contribution to literary scholarship in general and Twain studies in particular. This is decidedly third-rate Twain, but what of it? No work by Mark Twain is uninteresting or unimportant, after all, so anything he wrote should prove fascinating reading from a purely literary standpoint.

If we recovered a largely unknown and inferior play by Tennessee Williams, would it be of interest? Would its publication be almost a sacred duty? You bet your jumping frog it would. Even the failures of a genius command our attention.

Working with a text established by the incomparable Mark Twain Project team in Berkeley, Fishkin has gone beyond the previous researchers who gave slight notice to the play and has endeavored to bring it to public attention. And as the line goes from Arthur Miller's Death of a Salesman, "attention must be paid." So the student of literature, as well as theater, has much to mull over here. For better or worse, this is a complete work by Mark Twain, folks, and those don't pull into town on the noon stage every day.

From the purely Twainian standpoint, Is He Dead? is still more fascinating. The Twain buff can and should have a jolly time reading the play, noticing along the way how many distinct echoes there are of previous works. Liberally "borrowing" from himself, Twain pulls out the humorous description of the "long, low dog" (the dachshund) from Following the Equator. He appropriates the pungent idea of limburger cheese being mistaken for a rotting corpse from "The Invalid's Story." He repeats the routine of vague and perplexing answers from "An Encounter with an Interviewer." He resurrects jokes from "His Grandfather's Old Ram" in Roughing It. He lifts the device of the story's hero watching his own funeral from Tom Sawyer. And on and on goes the game of "spot the influences." In fact, the entire play is based on his 1893 short story, "Is He Living or Is He Dead?" In this tale, we are told how French artist Jean-Francois Millet faked his own death, knowing that unknown painters often become hot items after they are dead. Sure enough, the lionized Millet becomes "posthumously" rich and famous.

All of these associations are wonderfully detailed in Fishkin's insightful foreword and afterword material, which provide splendid background on "Mark Twain and the Theatre," "Mark Twain and Art," the real Millet's life and career, the play's many associations to other Twain works, the theater of Twain's day, and Twain's attempts to get Is He Dead? produced.

The Twainiac will find Fishkin's illuminating essays as valuable as the play itself. They provide all the necessary context for approaching and appreciating the comedy about Millet and his artist friends. You may not agree with Fishkin on the quality of the play, but you can't help being impressed by the thoroughness of her research and the vitality of her writing. As elegant as Fishkin's prose are the original illustrations by woodcut engraver Barry Moser, the Pennyroyal Press proprietor whose work graced the 100th anniversary edition of Huckleberry Finn published by the University of California Press in 1985.

Twain said he wrote the play for fun, and that's precisely how a Twain aficionado should read it. Some of the lines are vintage Twain. There are several nifty phrasings ("O, shucks! you don't know as much as an art-critic," one of the starving artists says to another). And the writer manages to sneak in a few withering satirical blasts at the art world, society and, of course, the French. In many ways, Is He Dead? is a better play than, say, Twain's miserable attempt to adapt Tom Sawyer. There's no whitewashing the ineptitude of that terribly off-key effort, which, despite being based on a book the author called "simply a hymn," also demonstrates Twain's tin ear as a playwright.

Salman Rushdie v Slumdog Millionaire

The author of The Satanic Verses doesn't seem to like the film any more than I do. From The Guardian:

What can one say about Slumdog Millionaire, adapted from the novel Q&A by the Indian diplomat Vikas Swarup and directed by Danny Boyle and Loveleen Tandan, which won eight Oscars, including best picture? A feelgood movie about the dreadful Bombay slums, an opulently photographed movie about extreme poverty, a romantic, Bollywoodised look at the harsh, unromantic underbelly of India - well - it feels good, right? And, just to clinch it, there's a nifty Bollywood dance sequence at the end. (Actually, it's an amazingly second-rate dance sequence even by Bollywood's standards, but never mind.) It's probably pointless to go up against such a popular film, but let me try.

The problems begin with the work being adapted. Swarup's novel is a corny potboiler, with a plot that defies belief: a boy from the slums somehow manages to get on to the hit Indian version of Who Wants to Be a Millionaire and answers all his questions correctly because the random accidents of his life have, in a series of outrageous coincidences, given him the information he needs, and are conveniently asked in the order that allows his flashbacks to occur in chronological sequence. This is a patently ridiculous conceit, the kind of fantasy writing that gives fantasy writing a bad name. It is a plot device faithfully preserved by the film-makers, and lies at the heart of the weirdly renamed Slumdog Millionaire. As a result the film, too, beggars belief.

It used to be the case that western movies about India were about blonde women arriving there to find, almost at once, a maharajah to fall in love with, the supply of such maharajahs being apparently endless and specially provided for English or American blondes; or they were about European women accusing non-maharajah Indians of rape, perhaps because they were so indignant at having being approached by a non-maharajah; or they were about dashing white men galloping about the colonies firing pistols and unsheathing sabres, to varying effect. Now that sort of exoticism has lost its appeal; people want, instead, enough grit and violence to convince themselves that what they are seeing is authentic; but it's still tourism. If the earlier films were raj tourism, maharajah-tourism, then we, today, have slum tourism instead. In an interview conducted at the Telluride film festival last autumn, Boyle, when asked why he had chosen a project so different from his usual material, answered that he had never been to India and knew nothing about it, so he thought this project was a great opportunity. Listening to him, I imagined an Indian film director making a movie about New York low-life and saying that he had done so because he knew nothing about New York and had indeed never been there. He would have been torn limb from limb by critical opinion. But for a first world director to say that about the third world is considered praiseworthy, an indication of his artistic daring. The double standards of post-colonial attitudes have not yet wholly faded away.

Kuttner v Geithner: Are Geithner's Days Numbered?

Liberals seem to be turning against Geithner...at least Robert Kuttner is.From the Huffington Post:

The government can either act quickly, the way the Swedes did when they faced a similar financial collapse; or the government can belatedly take banks over after delaying and trying half-measures, the way the Japanese did it. The Swedish economy got back on track and the banking system was returned to private ownership in fairly short order. The Japanese economy bled for a decade.

Why is Geithner dithering? Because he is asking the wrong question. The question he is posing is: how can the government save Citigroup? The right question is: how can the government rebuild the banking system?

Some in the administration may be wishing that they hadn't called in so many chits with senators to save Geithner from the consequences of his failure to comply with the tax laws. On the ability of Geithner (or his successor) to get this job done properly hangs the fate of the banking system, the capacity of the economy to avert a depression, and the political fortunes of the Obama administration.

Sunday, March 01, 2009

The Unsolved Mystery of Raoul Wallenberg's Fate

So, it was interesting that Prager's article explains why we still don't know what happened to Wallenberg--Western governments deliberately abandoned Wallenberg because of the Cold War, even Sweden's leaders and members of his own family didn't want to know:

Peter Wallenberg, 82, says his father, Marcus, who co-headed the family bank, had told him that Raoul's mother had asked the Wallenbergs not to interfere. "You didn't do things without total government consent," he added. "And there was not total government consent in regards to Raoul."Let me add my voice to the chorus: "Mr. Putin, Release Raoul Wallenberg's file!"

'Slippery as an Eel'

Mr. von Dardel increasingly scorned that government. He wrote that ambassador Rolf Sohlman was an "ineffective bastard," prime minister Erlander "slippery as an eel," foreign minister Undén "horrible."

***

The year was 2000. The siblings were to assume their brother dead. But Ms. Lagergren couldn't bring herself to do so. The time, she says, "was not ripe yet."

In January 2001, the Swedish-Russian group that included Mr. von Dardel published its final report on Mr. Wallenberg. It was inconclusive.

Days later, Swedish Prime Minister Göran Persson phoned the siblings. Recalls Mr. Persson: "It was an expression of apology from the kingdom of Sweden."

The prime minister failed to comfort. "How can one call after so many years?" asks Ms. Lagergren. "Just call?"

In short order, Mr. von Dardel broke his hip, got a pacemaker, caught pneumonia and, says his family, spoke less and less. He stopped speaking of his brother.

His doctors were unsure why. His family wasn't. "You understand now," says his daughter, Louise, "that the illness is Raoul Wallenberg illness."

In 2003, a commission appointed by the Swedish prime minister published "A Diplomatic Failure," an open critique of Sweden's policy toward its missing diplomat. "Diplomatic opportunities that might have helped Wallenberg were missed," says Sweden's current deputy foreign minister, Frank Belfrage.

Mr. Lundvik, the ambassador who long handled the Wallenberg case, is more blunt. "The Swedish government did not want him back," he says.

In 2005, Mr. von Dardel's younger daughter, Marie Dupuy, emptied the contents of her father's living-room closet into her Peugeot and drove it to her home in Versailles, France. She divided some 50,000 pages into 75 bins. One was devoted to her father's career in physics, 74 to his missing half-brother.

***

Eight days later, Mr. von Dardel sat silently in Room 233 of a Geneva hospital. Belted to a recliner chair, his hospital bracelet sliding over his thin right forearm, he listened to this reporter recount his family's search.

"I think it was very unfair," he said in a faint voice, of the brunt of two suicides on his sister. "Nina was in the center position."

Talk turned to the search.

"One should go to the top," he said.

Vladimir Putin?

"Yes."

What would he like to tell the Russian leader?

Days before turning 89, Mr. von Dardel summoned his strength: "If we sit down...try to find out...the real hope would be if new information..."

Did he still think about Raoul?

"Yes, I do," Mr. von Dardel answered in his strongest voice.

Later, he added: "I see him in Russia."

UPDATE: Recently received this email:

Dear Mishpucha,

Hope everyone is well.

Please find enclosed as an attachment a very moving Wall Street Journal newspaper article entitled "The Wallenberg Curse," by Joshua Prager. (You can also find the article at: http://online.wsj.com/article/SB123207264405288683.html)

It is the story of how the Raoul Wallenberg family tried to obtain justice for diplomat rescuer Raoul Wallenberg. As many of you know, Raoul Wallenberg volunteered to rescue Jews in Budapest from July 1944 through January 1945. He is credited with saving the lives of 20,000 Hungarian Jews.

On January 17, 1945, Raoul Wallenberg was arrested by the Soviet Army in Budapest.

It has been 64 years since Raoul Wallenberg was arrested by the Soviet occupying forces of Budapest. Still, there is no conclusive evidence as to what happened to him. Still his family grieves.

Raoul's brother, Guy von Dardel, and his sister, Nina Lagergren, have been seeking to determine the fate of their brother for decades. This has been an enormous emotional and financial burden for the family.

As you will see in the article, Raoul's mother and stepfather committed suicide in 1979 related to the emotional strain.

The family feels that the world has lost interest in finding justice for Raoul Wallenberg.

The Visas for Life: The Righteous and Honorable Diplomats Project supports the Wallenberg and von Dardel and Lagergren family in their quest for justice.

Our Project has included Raoul Wallenberg in all of our exhibition venues. We have sponsored Louise von Dardel, daughter of Guy von Dardel, to attend many of the Visas for Life exhibit venues. This included meetings with Secretary of State Colin Powell and Senators Feinstein and Boxer. We are presently developing a program to honor Raoul Wallenberg as part of a program to commemorate the activities of the US War Refugee Board, of which Raoul Wallenberg was an integral part.

The Visas for Life: The Righteous and Honorable Diplomats Project encourages the United States, Russia, Sweden, and Israel to continue the seek justice for Raoul Wallenberg and his family. We will continue to support the family in any way they feel appropriate. We hope you will join in that support.

If you wish to support the Wallenberg family or relay letters of support, please contact me at VisasForLife@cs.com.

Best regards,

Shalom,

Eric

Eric Saul

Executive Director

Visas for Life: The Righteous and Honorable Diplomats Project

Institute for the Study of Rescue and Altruism in the Holocaust, a nonprofit corporation

810 Windwood Place

Morgantown, WV 26505

(304) 599-0614

VisasForLife@cs.com

Subscribe to:

Comments (Atom)